The Effects of Greenhouse Gases Regulation on Wages and Rents: Policy Issues and General Equilibrium

Vol.05No.04(2016), Article ID:71785,17 pages

10.4236/ajcc.2016.54035

Meng-Jieu Chen

Department of Environmental and Natural Resource Economics, Coastal Institute, University of Rhode Island, Kingston, RI, USA

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: July 14, 2016; Accepted: November 1, 2016; Published: November 4, 2016

ABSTRACT

The stringency of environmental policy is likely to change the gains of economic agents. Using a general equilibrium model and an assumption that capital-intensive industries tend to be intensive emitters of greenhouse gases (GHG), we find that a stricter GHG emission scheme will reduce the rent for capital owners but increase the wage for workers. This effect could motivate capital owners or workers to oppose or support a stricter GHG policy. The paper also empirically assesses the model’s key assumption by using production input (capital stock and labor), output, and GHG emission data from U.S industrial sectors. The regression result supports a strong positive relationship between the capital-labor ratio and the pollution-output ratio. Therefore, the theoretical analysis is relevant to the actual economy.

Keywords:

Environmental Policy, General Equilibrium Model, Lobby, Incentive, Wage, Rent

1. Introduction

The benefits and costs associated with environmental policy may motivate people with common interest to coalesce for political action to influence the environmental policy making process. Olson (1971)’s classic analysis of economic incentives for collective action suggests that rational, self-interested economic agents have an incentive to form a political action group if net private benefits are expected to be positive [1] . Therefore, when firms in an industry foresee that an environmental policy will increase production cost, they are likely to form an interest group to lobby against that policy. Similarly, individuals who place high value on the environmental quality are motivated to actively participate in political processes that they expect to determine environmental outcomes. Thus, polluters and environmentalists become the two stereotypical advocacy groups on the environmental issues.

The same winner-loser idea is used in Grossman and Helpman (1994)’s trade policy model and many subsequent studies to explain the behaviors of government, polluters and environmentalists [2] . Lopez and Mitra (2000) present a game-theoretic model in which income transfer from a producer lobby to the government has a negative monotonic relationship to environmental policy stringency [3] . Fredriksson (1997) develops a model in which both environmentalists and producers try to form their own coalition to influence environmental policy [4] . Damania and Fredriksson (2003) show that not only collusive industries with higher collusive profits have a greater incentive to affect policy makers in formulating environmental regulation, but also those industries that are more polluting have equally strong incentive to form and contribute to a lobby so they can influence the environmental policy outcomes [5] . Svendsen et al. (2001) in their study on OECD CO2 taxation found that households pay a tax rate which is six times higher than that paid by the industry because industry lobbies harder against green taxation [6] . Gueterbock (2004) depicted in detail ExxonMobil’s scheme to undermine public trust in climate science by providing financial support to their political allies so they can continue to profit substantially from fossil fuel consumption [7] .

The literature focuses on the gain and loss of specific types of economic agents faced with environmental regulation but provides only limited explanations for the cost and benefit analysis for agents who do not fit into the stereotypes (environmentalists and polluters). A well-known example is the 1999 coalition between North American labor unions and environmental organizations (Kohn, 2002) [8] . The coalition’s goal was to reform the governance of international trade on environmental standards. However, the incentive of labor unions to join forces with environmental groups on a non-labor related issue is intriguing because the direct economic interest cannot provide justification for such a coalition.

After the 1999’s coalition, social scientists start to rationalize the engagement of seemingly unrelated interest groups in environmental policy lobbying. Fredriksson and Gaston (1999) find that a union’s attitude toward an environmental policy may be determined by the policy’s anticipated effect on unemployment [9] . Their study shows that with a risk of unemployment, unions lobby with employers to resist stricter environmental policies. When employment is secure, unions may support policies that reduce employment opportunities for nonunion workers.

Previous studies of the incentives for the nonstereotype groups’ involvement in environmental policy process only discuss labor unions’ incentives or firms’ abilities to lobby for (or against) an environmental policy. The interest of capital owners under a stricter environmental regime has not yet received much attention. In addition, discussion regarding the potential economic impact of a more stringent GHG emission policy on workers has also been limited to the unemployment concerns. Lacking a comprehensive theoretical framework, the cost and benefit of GHG reduction policy for labor and capital owners are discussed separately regardless of the fact that both labor and capital are fundamental production inputs. To establish a broader structure to explain the effects of a stricter emission policy on capital and labor providers’ economic interests, our study aims first to create a framework based on fundamental economic theory and then to empirically assess the underlying assumption of the framework. By investigating impact of GHG reduction policy on the resource owners, the theoretical analysis will provide insight regarding the owners’ welfare. The result will help to shed light on their support for or opposition toward a more stringent climate change regime.

2. The Model

A stringent climate change regulation achieves its goal through various policy options. These policy options usually require producers to increase labor or capital (or both) to reduce emissions. The technology standard, for example, is a type of regulation that requires firms to use a particular technology to reduce GHG emission. To comply with such a standard the firm has to spend more on capital to procure the specific technology that is required by law. An emission quota is another policy tool which receives much attention in pollution control. Unlike a technology standard, its flexibility allows firms to choose among various compliance options, which creates incentives for producers to increase abatement investment so that the conversion rate between quota and output will be high. Many countries use a Pigouvian tax in emission control. The pollution unit tax can speed up production substitution. Equipment and machinery with lower emission will replace the old ones quickly. Jorgenson and Wilcoxen (1990) find that pollution abatement has emerged as a major claimant on the resources of the U.S. economy as repercussions of environmental regulations [10] . Requate and Unold (2003) investigate use of environmental policy to encourage firms to adopt advanced abatement technology [11] . They find taxes provide stronger incentives than permits, auctioned and free permits offer identical incentives, and standards may give stronger incentives than permits. The increase in abatement provides strong evidence suggesting that once a new environmental instrument is adopted, the production structure and cost for producers will change.

The economy shifts toward a new equilibrium when a stringent GHG emission standard sets new constraints on firms’ production functions. Consequently, the input and output proportions may change. Assuming the polluting industry is capital intensive, this study applies Hechscher-Ohlin theory (Leamer, 1984; Ohlin, 1967) to find out how a more stringent GHG policy affects wages and profits [12] [13] .

The paper has two parts. In the first part, we build a theoretical model to explain the effects a more stringent GHG emission standard has on factor markets assuming that the high GHG emission industry in US is capital-intensive. The theoretical model will contain a closed economy model and a open economy model. In the second part, we analyze a data set to assess whether the high GHG emission industry in US is actually capital intensive, as assumed in the theoretical model. Although the model is designed to discuss the change in economic advantage of resource owners in US under a stricter GHG emission policy, it has similar implications for other effluent polltuion control and standards as long as similar positive relationship between pollution intensity and capital input intensity holds.

2.1. Closed Economy

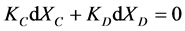

Consider a two-sector, closed economy in which one sector produces high amount of GHG per dollar’s worth of output but the other does not. The sectors employ two factors, capital (K) and labor (L), to produce two goods. The industry that has high GHG emission will be called the polluted or dirty industry while the other with low emission will be termed the clean industry. The polluted industry is assumed to be more capital intensive (less labor intensive) than the clean industry. In equilibrium, both factors are fully employed. The two-sector closed economy with full employment is depicted in Figure 1.

In Figure 1, XC0 and XD0 are the isoquants for the clean and dirty industry.  and

and  are the economy’s endowment of labor and capital. E is the equilibrium. The absolute value of the slope of line

are the economy’s endowment of labor and capital. E is the equilibrium. The absolute value of the slope of line

is the relative price of capital, that is, the price of capital in terms of labor. We can use the following equations to describe the economy.

is the relative price of capital, that is, the price of capital in terms of labor. We can use the following equations to describe the economy.

(1)

(1)

(2)

(2)

is amount of labor used to produce one unit of output for the clean industry in equilibrium.

is amount of labor used to produce one unit of output for the clean industry in equilibrium.  is the amount of labor used to produce one unit of output for the dirty industry in equilibrium.

is the amount of labor used to produce one unit of output for the dirty industry in equilibrium.  is the amount of capital used to produce one unit of

is the amount of capital used to produce one unit of

Figure 1. Edgeworth box for a two-sector closed economy.

output for the clean industry in equilibrium.  is the amount of capital used to pro- duce one unit of output for the dirty industry in equilibrium.

is the amount of capital used to pro- duce one unit of output for the dirty industry in equilibrium.  is the output of the clean industry in equilibrium.

is the output of the clean industry in equilibrium.  is the output of the dirty industry in equilibrium.

is the output of the dirty industry in equilibrium.  is the total labor demand.

is the total labor demand.  is the total capital demand.

is the total capital demand.  is the total labor supply.

is the total labor supply.  is the total capital supply.

is the total capital supply.

Theorem 1: Assume market always reaches equilibrium, an GHG reduction policy that take the form of a emission tax on the output of the dirty industry in a closed economy will eventually decrease real rent will decrease and increase the real wage. The tax shifts up the supply curve so the market equilibrium price increases and market equilibrium quantity decreases. Therefore, the polluted industry starts to contract1. When the polluted industry starts to contract, initially, the wage-rent ratio is unchanged in the factor market. However, the clean industry has to expand in order to reach full employment. But the clean industry is labor intensive. The initial factor price ratio will be inconsistent with the factor market equilibrium, since it will involve an excess demand for labor and/or excess supply for capital. This occurs because at initial factor prices, the expanding industry tries to attract more labor per unit of capital than the contracting industry releases. This leads to a change in relative factor prices.

Proof: First we assume one factor input unchanged and allow the other to change with the change in outputs for the two industries. So starting with K fixed, we have

(3)

(3)

(4)

(4)

(5)

(5)

Now we allow L change to with the output.

(6)

(6)

(7)

(7)

(8)

(8)

Because polluted industry is capital intensive and clean industry is labor intensive, we have the following relationship :

(9)

(9)

(10)

(10)

Using the relationship in Equation (10), we find the term  is positive. So the numerator in Equation (8) is positive. Equation (8) tells that when

is positive. So the numerator in Equation (8) is positive. Equation (8) tells that when  in- creases, L must move in the same direction.

in- creases, L must move in the same direction.

Next, we assume L is unchanged and solve for the relationship between  and

and . The same process applies and we find,

. The same process applies and we find,

(11)

(11)

Since the term  is negative, when

is negative, when  increases, K must decrease.

increases, K must decrease.

Equations (8) and (11) mean that, if both factor markets initially clear, an expansion of the clean industry and contraction of the dirty industry will create, at initial factor prices, excess demand for labor and/or excess supply of capital. When there will be excess demand for labor, the wage must increase. Also, when there is excess supply of capital, the rent must decrease. The adjustment process will happen until the market reaches equilibrium again. This can be proved by the following:

Assume that the production function for the polluted industry, written as

(12)

(12)

is linear homogeneous, so that

(13)

(13)

Defining  and

and , we can write,

, we can write,

(14)

(14)

Assuming that  and

and , we have

, we have  and

and . The mar- ginal product of labor (

. The mar- ginal product of labor ( ) and marginal product of capital (

) and marginal product of capital ( ) are derived as follows:

) are derived as follows:

(15)

(15)

(16)

(16)

Equation (15) and Equation (16) show that the two marginal product only depend on . Furthermore,

. Furthermore,

(17)

(17)

and

(18)

(18)

The real wage rates for labor and capital are determined by the marginal product of labor and the marginal product of capital. That is:

(19)

(19)

(20)

(20)

Analogous equations relate to the clean industry:

(21)

(21)

(22)

(22)

(23)

(23)

(24)

(24)

When the new policy shifts the equilibrium from  to

to  (see Figure 2),

(see Figure 2),  and

and  both rise. Hence,

both rise. Hence,  and

and  fall and

fall and  and

and  rise. Therefore, the real rent will decrease and the real wage will increase.

rise. Therefore, the real rent will decrease and the real wage will increase.

Figure 2 illustrates the adjustment process toward the new equilibrium.  and

and  are the initial isoquants for clean and polluted industries. After the government implements the new regulatory policy on GHG emission, the polluted industry contracts to

are the initial isoquants for clean and polluted industries. After the government implements the new regulatory policy on GHG emission, the polluted industry contracts to . Such contraction leads to excess labor and capital supply. For input factor market to reach full employment, the clean industry will have to expand. Since clean industry is labor intensive, the labor demand from clean industry in explansion

. Such contraction leads to excess labor and capital supply. For input factor market to reach full employment, the clean industry will have to expand. Since clean industry is labor intensive, the labor demand from clean industry in explansion

Figure 2. Edgeworth box for the new equilibrium.

will be greater than the labor supply released from the polluted industry’s contraction while the opposite outcome occurs in capital market. Excess labor demand and excess capital supply would inevitablely drive up the wage and lower the rent so the market can be clear again. In Figure 2, the new equilibrium emerges at  where the demands for labor and capital are equal to supply. The absolute value of the slope of line

where the demands for labor and capital are equal to supply. The absolute value of the slope of line

is the new relative price of capital in terms of labor. According to our analysis of factor input prices during adjustment, line

is the new relative price of capital in terms of labor. According to our analysis of factor input prices during adjustment, line

should be flatter than line

should be flatter than line

. It means the new relative price of capital is lower than the initial price at E.

. It means the new relative price of capital is lower than the initial price at E.

2.2. Open Economy

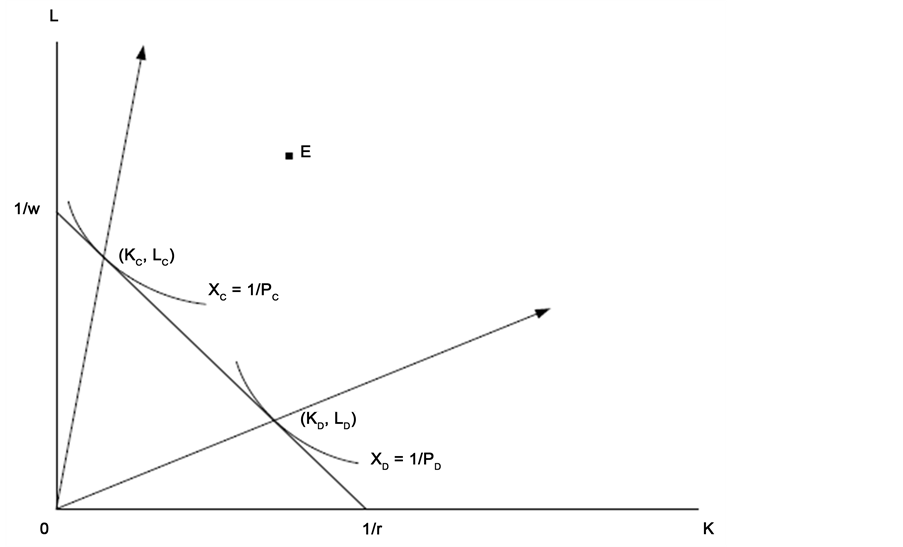

The open economy model also has two industries, one is dirty and the other is clean. Both industries are assumed to be perfectly competitive. Again, the dirty industry is capital intensive and the clean industry is labor intensive. This model is represented by a Lerner Diagram (Figure 3), in which  and

and  are the unit value isoquants for clean and polluted industries.2 The two industries’ unit value isoquants are tangent to the same unit value isocost line. The absolute value of the slope of the unit value isocost line is the ratio of the rental cost of capital to the wage rate. Assume the endowment of labor and capital, E, falls inside the cone so that factor markets clear for some combination of positive output levels for the two industries.

are the unit value isoquants for clean and polluted industries.2 The two industries’ unit value isoquants are tangent to the same unit value isocost line. The absolute value of the slope of the unit value isocost line is the ratio of the rental cost of capital to the wage rate. Assume the endowment of labor and capital, E, falls inside the cone so that factor markets clear for some combination of positive output levels for the two industries.  and

and  are the commodity prices for the clean and polluted industry. Because it is an open economy,

are the commodity prices for the clean and polluted industry. Because it is an open economy,  and

and  are exogenous to the model. To avoid a profit or loss that would lead to

are exogenous to the model. To avoid a profit or loss that would lead to

Figure 3. Lerner Diagram for two sector open economy: prior to a stringent standard is adopted.

entry or exit, this cost-minimizing bundle of factors must also be worth exactly one dollar, just like the output it produces. Therefore, the isocost line drawn through the tangent point must represent one dollar’s worth of factors. Hence its vertical intercept is one dollar worth of labor, or one over the wage w, while its horizontal intercept is one dollar worth of capital, one over the rental r, as labeled.

Before a higher GHG standard is implemented, the dirty industry and the clean industry isoquants are tangent with the unit isocost line at ( ,

, ) and (

) and ( ,

, ) respectively. A set of equations describing the relationships among K, L, r and w are as follows:

) respectively. A set of equations describing the relationships among K, L, r and w are as follows:

(25)

(25)

(26)

(26)

is amount of labor per dollar of output in the clean industry.

is amount of labor per dollar of output in the clean industry.

is amount of capital per dollar of output in the clean industry.

is amount of capital per dollar of output in the clean industry.

is amount of labor per dollar of output in the dirty industry.

is amount of labor per dollar of output in the dirty industry.

is amount of capital per dollar of output in the dirty industry.

is amount of capital per dollar of output in the dirty industry.

and

and  are the factor prices.

are the factor prices.

The two sectors are price takers in the world market. Therefore, prices are treated as given. The isoquants, at their tangencies with the isocost line, have the same slope.

Theorem 2: In an open economy, an GHG reduction policy that take the form of a emission tax on the output of the dirty industry also leads to lower real rent will and higher real wage . This is because the new GHG reduction policy requires the polluted industry to use more labor and capital per dollar of output. It shifts out the unit value isoquant for the polluted industry.

Proof:

In an open economy, the slope of the old tandent (unit isocost line) is

(27)

(27)

After a stricter GHG standard is implemented, the new tangent is illustrated in Figure 4. At cost minimization, the slope of the new tangent is :

(28)

(28)

And

(29)

(29)

Once again, MPK stands from marginal product of capital and MPL stands for mar- ginal product of labor. Equation (29) holds true at equilibrium.

Therefore, in the old equilibrium

(30)

(30)

Similarly, at the new equilibrium, . From the Lerner Diagram,

. From the Lerner Diagram,

we can see that the new tangency on the clean industry’s isoquant is to the right of the old tangency. Therefore, at the new tangency, the capital labor ratio is greater than the old tangency. It means  will become lower and

will become lower and  will become greater. Thus the rent-wage ratio (r/w) will fall from the old equilibrium to the new equilibrium.

will become greater. Thus the rent-wage ratio (r/w) will fall from the old equilibrium to the new equilibrium.

Figure 4 describes such a change. A new isocost line will be established tangent to the new isoquant of the polluted industry and the old isoquant of the clean industry. At the new tangency, the amounts of labor and capital used are ,

,  ,

,  , and

, and .

.

At cost minimization, the slope of the new isocost line through two tangent points is . From the Lerner Diagram, we can see that

. From the Lerner Diagram, we can see that  is greater than 1/r and

is greater than 1/r and  is

is

small than 1/w. In another word,  is smaller than r and

is smaller than r and  is greater than w. It means the absolute value of the slope of the new isocost line is smaller than that of the old isocost line. Compared with the initial equilibrium, the rent will be reduced and the wage rate will be higher.

is greater than w. It means the absolute value of the slope of the new isocost line is smaller than that of the old isocost line. Compared with the initial equilibrium, the rent will be reduced and the wage rate will be higher.

The implication for the model (in which the dirty industry is capital intensive) is that capital owners have an incentive to oppose a stringent GHG policy and workers have an incentive to ally themselves with environmental groups lobbying for a stricter standard.

3. Empirical Study

The theoretical models developed above are based on the assumption that the polluted

Figure 4. Lerner Diagram for two sector open economy: after a stringent standard is adopted.

industry is capital intensive. The assumption captures the general impression that high GHG emission industries in US seem to involve high levels of capital in production. The petrochemical industry and oil drilling industry are examples. However, to streng- then our theoretical work, it is important to use empirical data to verify this assumption. The aim of this section is to find out if there is a positive correlation between capital labor ratio and GHG emission-output ratio across US industries.

The US has extensive time-series production input and output data. We use total hours of labor input and productive capital stock to estimate the labor-capital ratio at the industry level. When estimating capital input as the production factor, the common practice is to include equipment and structures. Inventory and land are not included. Both capital and labor data come from the Bureau of Labor Statistics (BLS). The capital input data includes the following sectors: private business, private nonfarm business, manufacturing, farm sector and nonfarm nonmanufacturing. Productive capital stocks are derived from the National Income and Product Accounts (NIPA) investment which uses the perpetual inventory method and assumes that capital services decline as a function of age to obtain the estimates of capital stock value. BLS provides industry level capital input data and labor input data based on the North American Industry Classification System (NAICS). The NAICS code is the standard used by Federal agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. industries.

We calculate industry level pollution intensity as pollution per unit of value added.3 The data on value added by industries (as delineated in NAICS) are provided by the Bureau of Economic Analysis (BEA).

The US Environmental Protection Agency (EPA) ranks the industrial sectors as the major greenhouse gas contributing end-user sectors. The most detailed source of information on U.S. GHG emissions is the Inventory of U.S. Greenhouse Gas Emis- sions and Sinks [14] , issued by the EPA Office of Atmospheric Programs. This source provides detailed emissions data, broken down by industrial process. Only in a few cases (cement manufacturing, for example) does the breakdown by process correspond to the breakdown by NAICS code sector. We find that it is impossible to derive sector- specific information directly from the process data provided in the Inventory. However, in our study, a sector-specific breakdown is desirable. One way to derive reliable industrial GHG estimates is to convert the current sectoral energy consumption data to carbon dioxide equivalence. This is the approach that is recommended by the National Center for Manufacturing Sciences. According to EPA, energy consumption is the major source of industrial GHG emission. The approach adopted for our study is based on the fact that, for many sectors, the total contribution of the sector processes to overall GHG emissions is dominated by the carbon dioxide generated from fossil fuel combustion. Therefore, data from the Energy Information Administration (EIA) of the US Department of Energy Information on energy consumption for specific fossil fuel types, broken down by sector, can be used to convert to sectoral GHG emission. Because the carbon content of each fossil fuel type is known, using an estimated conversion factor one can convert fuel usage figures into GHG emissions for each sector covered by the EIA energy usage information.

EIA has energy consumption data for 21 manufacturing sectors based on 3 digit NAICS code for years 1998, 2002 and 2006. The 21 manufacturing sectors in the EIA dataset are listed in Table 1.

Table 1 clearly shows that major industrial sectors are included in the EIA energy statistics. The data capture most of the emission in manufacturing industry. Cross referencing the industry sectors in both EIA data and EPA inventory, EIA fossil fuel consumption data based on NAICS codes provide a reasonably close mapping to the selected sectors that are of interest for the GHG concern. For example, sectors such as Agricultural Chemicals, Aluminum, Automobile Assembly, Cement, Chemicals, Computers and Electronics, Iron and Steel, Petroleum Refining, Plastics, Pulp and Paper, Rubber, Semiconductors, Stone, Clay and Glass, Textiles, and Wood products have been the important GHG contributors in the manufacturing industry, according to the inventory (US EPA report). All of these sectors are categorized into the NAICS codes that are listed in Table 1. Their corresponding 3 digit NAICS code are: 325, 331, 336, 327, 325, 334, 331, 324, 325, 322, 326, 334, 327, 313, and 321.

Total energy consumption for each sector is estimated based on data for energy generated from the following energy sources: net electricity, residual fuel oil, distillate fuel oil, natural gas, liquefied petroleum gases (LPG) and natural gas liquids (NGL), coal, coke and breeze4, other, and shipments of energy sources produced on site. The total energy consumption is the sum of all of the listed energy sources, including

Table 1. Industrial sectors that are listed in the EIA energy consumption dataset.

“other”, minus the shipments of energy sources produced on site. It is the total amount of first use of energy for all (fuel and nonfuel) purposes. Shipments of energy sources produced on site are those shipments produced or transformed on site from the nonfuel use of other energy sources. For example, at an establishment that processes coal to make coke for later use, the entire quantity of coal is counted as first use. Any onsite consumption of coke is not counted as first use because it would duplicate the coal use. If some of the coke is then sold to another establishment, then that second establishment will consider this coke to be a shipment of an offsite-produced energy source. Hence, the second establishment will count this coke as its first use, thereby resulting in double counting. In order to eliminate the double counting, the energy equivalent of the coke shipment must be subtracted from first use.

The Environmental Roadmapping Initiative of the National Center for Manufactur- ing Sciences provides conversion factors for each EIA’s fuel type. Table 2 shows the GHG conversion factors for the EIA energy sources.

Using the conversion factors, we derive the total GHG emission from EIA sectoral energy consumption data. Then dividing GHG emission by value added, we can obtain data on emission per dollar, which is the dependent variable in our model. Using the capital labor ratio as the regressor, we obtain the regression result shown in Table 3 model 1.

Table 2. GHG conversion factors by energy types.

Table 3. Regressions for pollution per dollar of output.

The numbers in parentheses are t-ratios. The numbers above those in parentheses are point estimates of coefficients.

The sign of the coefficient for K/L ratio is positive, which is consistent with our expectation. It means that in our panel dataset, high capital intensity is positively associated with high GHG emission intensity. Furthermore, the t ratio for capital is large and significant. It supports our assumption that a polluted industry is indeed capital intensive in US.

Because industry level time series data are used in our data, time-varying factors such as technological progress, weather/temperature, change in regulations, or economic cycle could also affect GHG emission per dollar. Therefore, we need to extend our model by adding year dummy variables to separate influence of the time related factors on pollution intensity to increase the robustness of the model. The regression result for the second model is also in Table 3. Model 2 shows the coefficient of K/L ratio is consistent with the result in the first regression model and its value and t ratio are larger than the result in the first model. Model 2 also has better goodness of fit (  ).

).

There are two year dummies in model 2, but only the coefficient for year 2006 reaches the level that is necessary for statistical significance. This seems to be encouraging because it shows that the US major manufacturing sectors have decreased GHG intensity in the production process in the recent years. The reduction could be the result of the change in both environmental regulations and the public awareness in response to the concern of global warming. However, complete time series data and further research are required to pin down the underlying factors that contribute to the improvement.

4. Conclusions

When general equilibrium theory is applied to predict the effect of a higher GHG emission standard on factor prices, the inference is that wages will rise and the rental cost of capital will fall. If workers and capital owners take political positions based on economic self interest, stricter GHG policies will be supported by the former and opposed by the latter. The result of our empirical study shows strong evidence to support the assumption that the capital intensive sectors tend to produce more GHG since the coefficient of capital-labor ratio is positive and statistically significant. It suggests that when US economy becomes more capital abundant, it is likely to be dirtier if there is no adequate government intervention on GHG emission. Policy makers should be cautious about the environmental consequence when designating investment policy to increase capital stock in the production process to pursue economic development.

An important implication from our result is that capital owners have an incentive to join forces across sectors to oppose the GHG reduction policy. The imposition of a stringent GHG control policy will decrease the capital price relative to product prices and increase wages relative to these product prices. This provides incentives for self- interested capital owners to oppose to a stricter environmental policy and for laborers to support it.

To the extent that firms use their own capital, rather than borrowed capital, firms in capital-intensive industries will have an incentive to join the coalition against GHG reduction policies. For the firms that rely on capital markets to finance their operation, their creditors and shareholders would be pleased to see corporate lobby against higher GHG standards. In most industrial countries, GHG reduction policy has thus far tar- geted only the electricity companies. With stricter policies towards climate change, the energy end users will soon find themselves under government regulation for GHG especially the major manufacturing sectors that have high electricity demand. As a result, there is a great likelihood that the rent seeking, highly capitalized industry will vigorously work together against the GHG abatement policy.

In view of the political power of capital owners and capital-intensive corporations to block GHG emission reduction regimes that threaten their economic interests, mitigat- ing the negative impact of environmental policy on the return to capital should be an important consideration in strategizing US national climate change policy. This would help the reduction scheme to receive widespread bipartisan support. Any policy options that avoid contraction of the high emission industry would alleviate the rent loss for capital owners. For example, capital owners and capital-intensive corporations would probably accept a government program to subsidize incentive to encourage innovation on GHG emission production technology in order to lower producton cost.

Another approach to create a political environment conducive to the passage of stricter GHG emission regulations involves changing the electoral process. By putting a limit on corporate spending in campaigns for Congress, the heavy corporate clout in the capitol would be restricted. Laborers and capital owners would then have a fair chance to have their voices heard in Congress on the climate change policy. However, the recent Supreme Court decision that rejects limit on corporate spending in elelction campains5 seems to lead US politics to the opposite direction [15] .

Skeptism about climate science may seem particular surprising when voiced by political leaders of the United States, a country at forefront of scientific research. However, applying general equilibrium theory to the U.S. economy, we find that capital owners will face rent decreases while laborers will receive wage gains if stricter GHG standards are adopted. This class divide could be an underlying cause for the polarized policy preferences on climate change issues. The results of the Gallup Environmental Poll, which span a decade, also confirm the gap between climate views expressed by Republicans and Democrats. In the 2008 Gallup Poll, we see that Republicans have become somewhat less likely over the past decade to believe that global warming is already occurring (from 48 to 42 percent), while Democrats have become much more likely to hold this belief (from 52 to 76 percent) (Dunlap and McCright, 2008) [16] . Our paper’s analytical results provide a possible explanation of the divergent trends between Republicans and Democrats by suggesting that the economic interests of capital and labor may be one of the fundamental factors. Being the world’s second largest CO2 emitter, the US should actively seek feasible reduction choices that would dimish economic impact associated with GHG reduction policy, and this will undoubtedly help the two parties to reach political comprimise on the US climate change policy.

Cite this paper

Chen, M.-J. (2016) The Effects of Greenhouse Gases Regulation on Wages and Rents: Policy Issues and Gen- eral Equilibrium Analysis. American Journal of Climate Change, 5, 485-501. http://dx.doi.org/10.4236/ajcc.2016.54035

References

- 1. Olson, M. (1971) The Logic of Collective Action: Public Goods and the Theory of Groups. Harvard University Press.

- 2. Grossman, G. and Helpman, E. (1994) Protection for Sale. American Economic Review, 84, 833-850.

- 3. Lopez, R. and Mitra, S. (2000) Corruption, Pollution, and the Kuznets Environment Curve. Journal of Environmental Economics and Management, 40, 137-150.

http://dx.doi.org/10.1006/jeem.1999.1107 - 4. Fredriksson, P.G. (1997) The Political Economy of Pollution Taxes in a Small Open Economy. Journal of Environmental Economics and Management, 33, 44-58.

http://dx.doi.org/10.1006/jeem.1996.0979 - 5. Damania, R., Fredriksson, P.G. and List, J.A. (2003) Trade Liberalization, Corruption, and Environmental Policy Formation: Theory and Evidence. Journal of Environmental Economics and Management, 46, 490-512.

- 6. Svendsen, G.T., Daugbjerg, C., Hjollund, L., et al. (2001) Consumers, Industrialists and the Political Economy of Green Taxation: CO2 Taxation in OECD. Energy Policy, 29, 489-497.

http://dx.doi.org/10.1016/S0301-4215(00)00145-2 - 7. Gueterbock, R. (2004) Greenpeace Campaign Case Study—StopEsso. Journal of Consumer Behaviour, 3, 265-271.

http://dx.doi.org/10.1002/cb.139 - 8. Kohn, R.E. (2002) A Heckscher-Ohlin-Samuelson Interpretation of the Labor-Environmental Coalition in Seattle. Atlantic Economic Journal, 30, 26-33.

http://dx.doi.org/10.1007/BF02299144 - 9. Fredriksson, P.G. and Gaston, N. (1999) The “Greening” of Trade Unions and the Demand for Eco-Taxes. European Journal of Political Economy, 15, 663-686.

http://dx.doi.org/10.1016/S0176-2680(99)00031-2 - 10. Jorgenson, D.W. and Wilcoxen, P.J. (1990) Environmental Regulation and U.S. Economic Growth. RAND Journal of Economics, 21, 314-340.

http://dx.doi.org/10.2307/2555426 - 11. Requate, T. and Unold, W. (2003) Environmental Policy Incentives to Adopt Advanced Abatement Technology: Will the True Ranking Please Stand up? European Economic Review, 47, 125-146.

http://dx.doi.org/10.1016/S0014-2921(02)00188-5 - 12. Leamer, E.E. (1984) Sources of International Comparative Advantage. MIT Press.

- 13. Ohlin, B. (1967) Interregional and International Trade. Harvard Economic Studies. Harvard University Press.

- 14. United States Environmental Protection Agency (2010) US Greenhouse Gas Inventory Report. Technical Report. US EPA No. 430-R-10-006, Washington DC.

- 15. Liptak, A. (2010) Justices, 5-4, Rejected Corporate Spending Limit. The New York Times.

http://www.nytimes.com/2010/01/22/us/politics/22scotus.html?_r=0 - 16. Dunlap, R.E. and McCright, A.M. (2008) A Widening Gap: Republican and Democrat View on CLIMATE change. Environment, 50, 26-35.

http://dx.doi.org/10.3200/ENVT.50.5.26-35

NOTES

1Instead of assuming a tax on the dirty industry, we could assume that the government imposes on the dirty industry a pollution abatement requirement that raises capital and labor input requirements per unit of output proportionately, causing unit costs to rise. Provided that demand elasticity is greater than 1 in absolute value, the industry’s revenue will fall. As its revenue falls, its demand for capital and labor inputs will decrease.

2A unit value isoquant consists of input bundles that generate the amount of output that has a market value of 1 dollar.

3Valued-added output is an appropriate measure for industry output because it excludes the value of intermediate inputs. Some industries have a high value of intermediate inputs, using the value of total commodity output in this case will exaggerate the value of output the industry creates. By choosing value-added as the measure of output we can avoid overestimating the actual value of the output.

4A by-product of coke manufacture; it is the residue from the screening of heat-treated coke. The particle size is less than 10 mm.

5Available at: http://www.nytimes.com/2010/01/22/us/politics/22scotus.html [accessed on July 10, 2011].

上一篇:A Stock-Recruitment Relationsh 下一篇:Global Climate Model Selection

最新文章NEWS

- Implications of Land Use Land Cover Change and Climate Variability on Future Prospects of Beef Cattl

- A Stock-Recruitment Relationship Applicable to Pacific Bluefin Tuna and the Pacific Stock of Japanes

- The Effect of Extreme Climatic Events on Extreme Runoff in the Past 50 Years in the Manas River Basi

- Case Study: Reviewing Methods of Assessing Community Adaptive Capacity for Jefferson County, Texas

- Comparison of Two Reef Sites on the North Coast of Jamaica over a 15-Year Period

- Observed and Future Changes in the Temperature of the State of Jalisco, México Using Climdex and PRE

- Hydrological Impact Assessment of Climate Change on Lake Tana’s Water Balance, Ethiopia

- Changes of Reef Community near Ku Lao Cham Islands (South China Sea) after Sangshen Typhoon

推荐期刊Tui Jian

- Chinese Journal of Integrative Medicine

- Journal of Genetics and Genomics

- Journal of Bionic Engineering

- Pedosphere

- Chinese Journal of Structural Chemistry

- Nuclear Science and Techniques

- 《传媒》

- 《中学生报》教研周刊

热点文章HOT

- Options for Greenhouse Gas Mitigation Strategies for Road Transportation in Oman

- Implications of Land Use Land Cover Change and Climate Variability on Future Prospects of Beef Cattl

- Sea Water Intrusion Modeling in Rashid Area of Nile Delta (Egypt) via the Inversion of DC Resistivit

- Hydrological Impact Assessment of Climate Change on Lake Tana’s Water Balance, Ethiopia

- Effects of land use on the Soil Organic Carbon storage potentiality and soil edaphic factors in Trip

- Case Study: Reviewing Methods of Assessing Community Adaptive Capacity for Jefferson County, Texas

- Economic Growth and CO2-Emissions: What If Vietnam Followed China’s Development Path?

- Land Cover Changes in Lower Jubba Somalia