Rich and Poor

Vol.03No.05(2014), Article ID:52494,12 pages

10.4236/ahs.2014.35023

Birger P. Priddat

Faculty of Economic Science, University of Witten/Herdecke, Witten, Germany

Email: birger.priddat@uni-wh.de

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 8 October 2014; revised 20 October 2014; accepted 14 November 2014

ABSTRACT

Starting with the medevial poor/rich-topics in the Acquinian tradition of the theological economy of charity, the article develops a rather unkown line in the history of economic thought from Tho- mas Acquiniusto John Locke and Adam Smith. The rich/poor-distribution of the charity-principle transforms over John Lockes’ property/labor-relation in the new Smithian capital/labor-econo- mics. It is a special European line from charity-distribution to labor/capital-accumulation.

Keywords:

History of Economic Thought, Medevial Economics of Charity, Thomas Acquinius, John Locke, Adam Smith, Distribution

1. Introduction

In pre-classical economics, division of income was traditionally represented as an antithesis of rich and poor. Specific income classes were only defined in “classical” economics: landed property owners drew rents, capital investors profits and the workers’ wages. Only those not belonging to these classes counted as “poor” and were the subject of welfare or the poverty police. The poor were not economic subjects, belonging instead to a class which had dropped out of the allocation process and which was characterized above all by its unwillingness to work1. Nonetheless, they were members of this society. The pre-classical difference between rich and poor ranges between the market and non-market spheres. “Classical” economics provided, as will be shown, a specific solu- tion to this difference―which had determined an important part of pre-classical economics: What type and how much redistribution is necessary in order to master poverty?

“Any country which has to care for many poor, and has to establish public institutions for this, thus shows that its commerce and manufacturing as well as farming and agriculture has declined drastically, that Christian bro- therly love has become very cold among the people, and that one is not able either to make a proper selection among the poor nor that one has such an administration which with sufficient authority, penetration and care is able to put into practice the media serving the welfare of the poor. Where commerce and manufacturing, includ- ing livestock, agriculture and horticulture flourish, no one need beg, instead everyone who wishes to work can earn his bread”2.

Marperger’s text from 1733 reflects the modern transformation of the poverty question which―prototypically ―began with J. Locke and which took a special turn, with Adam Smith, into a general full-employment pros- perity based on an accumulation process. The starting point, however, is the Christian―Scholastic topic of rich and poor, in which “external goods” were distributed according to the criteria of a higher justice. This modern transformation will be reconstructed in three stages.

The first stage is defined by Scholastic, or more exactly, the Thomasian type of charity economics (Section 2). The second stage examines J. Locke’s inversion of the charity model’s relation between rich and poor (Section 3); the third the Smithian consequences (Section 4).

All the intermediate stages and differentiations have been excluded in favor of the prototypical conceptions, as only so does the line of development appear, one which only broke off with the innovation of English “clas- sical” economics in the 19th century; that of raising the new problem of the “social question”, which was related only metaphorically to the proto-economic definition of rich and poor in pre-classical economics3.

2. The Economic Structure of the Pre-Classical Rich/Poor Topic

In Europe the development of economic ideas was fundamentally influenced by Aristotle4. Thomas Acquinus was the famoust of the scholastic philosophers who transformed the Aristotelian basics into the right the ologi- can version5.

In the Thomasian rich/poor topic, wealth and poverty is a worldly inequality among men in principle equal before God. Thomas’ system of goods is structured as follows6:

External goods have no purpose in themselves, serving instead the highest good of the fruitiodei. The rich/ poor differentiation is located in the lower section: As relation between necessarium, extrema necessitas and su- perfluum.

The necessarium is subdivided into two: on the one hand in the sense of a minimum subsistence level (extra- ma necessitas), on the other in the sense of a livelihood in accordance with one’s rank. Any income above and beyond this second necessarium is a superfluum, i.e. that surplus which should be given charitably to the poor.

Thus the necessarium is limited at both ends: it is not to fall below the subsistence level, but equally may not fail to fulfill the duty of giving alms as otherwise the accusation of avaritia, of greed, would be raised. “Neglect- ing the duty to give alms is held to be a deadly sin”7.

“God distributes that wealth which goes beyond livelihood in accordance with one’s rank only for the purpose that the owner may acquire merit through good distribution. That which goes beyond the necessarium may not be used for oneself and, on the other hand, one should not give that much that one’s living standard sinks below the necessarium”8.

Poverty is defined as unemployment, i.e. as a state of not drawing any income from an occupation. Consump- tion Ca consequently tends towards zero if rich Christians do not make possible a constant social transfer with their alms. For income use, it is true that:

(Cr represents the consumption of the rich, Ca that of the poor), whereby Ca tends towards zero, i.e. the poor are excluded from the reduced economic equation Y = Cr (the middle income class is not dealt with as their in- come is sufficient for maintenance in accordance with rank and no superfluum for charitable redistribution re- mains).

Charity describes a transformation of the equation

,

,

where by the difference rich/poor is not invalidated (Cr > Ca), but the subsistence level for the poor is ensured by a minimum income provided through a social transfer (Only heretical, radical Christian versions demanded Cr = Ca, i.e. an abolition of the difference between rich and poor in an (Assisian or true Christian) community of poverty before God).

In this charity-economy, while the needs of the poor is a claim on all Christians, their level of this income re- mains undetermined and only defined by the level of the superfluum. The poverty of their brothers in Christ ob- liges the rich to provide a constant social transfer, but the level of his transfer contribution is not determined solely by the requirements of the poor but also what he can spare as superfluum9.

If all the rich followed the charitable norm of distributing their superfluum among the poor, they would be acting morally towards their “brothers”, ensuring both the stability of Christianity and their being blessed by God’s mercy. No one would be denied participation in human society simply because he has fallen on hard times on Earth. A rich man’s Christian duty to surrender his surplus will be rewarded at on Judgement Day. Countering a tendency towards avaritia, greed, to use the entire wealth for oneself, a long-term utility is post- ulated in the possibility of purchasing a place in paradise through active brotherly love. Charity is, in economic terms, an investment in “transcendental capital”.

However, charity distribution is not economic behavior in the narrow sense of the word: It supposes a moral decision to give greater weighting to the future utility of a place in paradise than to the current utility of living in wealth. Motivation is moral, and the poor’s claim to alms abstract as long as the rich do not voluntarily decide for social transfer. The church―above all the sermon as a public, moral appeal―here functions as moral institu- tion, waking the rich believers’ willingness to pay (when they do not use it for their own maintenance and their own wealth).

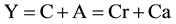

The charity economy has the following structure:

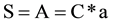

1)  (Y = total income; C = consumption; S = superfluum)

(Y = total income; C = consumption; S = superfluum)

2)  (A = alms; A = Ca, i.e. the consumption of the poor)

(A = alms; A = Ca, i.e. the consumption of the poor)

3)  (Cr = consumption of the rich)

(Cr = consumption of the rich)

The normative condition 2) S − A in turn depends on what is defined as income or consumption in accordance with rank. If we define consumption in accordance with rank of the rich as C*r and the subsistence level of the poor as C*a (the extrema necessity as interpreted in accordance with rank), then the normative equation would be

,

,

in which C*a = Y − Cr invalidates an independent definition of being in accordance with rank for Cr. Any au- tonomous definition of the necessarium (C*r)/superfluum (S)―equation for the rich would have the unchristian characteristic of allowing the possibility of the consumption of the poor to fall below the necessary transfer level (extrema necessitas). In this normative―radical version, the claims of the poor on charity transfer (C*a) deter- mine the level of consumption that charitable duties allows the rich, that is, that part of their income which makes up the superfluum.

To this extent, a voluntary moral decision on the part of the rich is not sufficient to effectively guarantee care of the poor, as long as only the condition S > 0 applies. To fulfill

,

,

a charity market would have been required which revealed the effective requirements of the poor in order to al- low an effective superfluum supply. As long as moral liberty consists of being able to define S < C*a, distribu- tion of the superfluum remains undetermined, there is no guarantee that all the poor will reach the extrema ne- cessitas level.

There are no general welfare criteria as there is no collective fund of all the rich, no S collection. Individual alms transfer favors, in principle, one or another group of poor over others.

The specific pareto-optimum of the charity economy consists of not employing the innocent utility of the god-willed, mercifully granted wealth to the disadvantage of those innocently (from God’s wise resolution) in want. As there is no economic relation, except a moral rule of distribution, between the rich and poor, pareto- optimal participation of the poor in the prosperity of the rich is a moral norm with the disadvantage of having no yardstick of efficiency apart from a moral payment of debts.

Everything depends on how “in accordance with rank” is defined; this shifts, however, as incomes develop. The institution of the church, as quasi-regulator of the S − A equation was not necessarily interested in setting C*a at a high level, because with a relatively high S and a constant Cr, the level of demand on the church rises10.

The church’s preferences alternated between its function as charity collector and its own welfare maximiza- tion, depending on the cycle of its involvement and development in the Middle Ages. Depending on the (estate) political constellation, even with a growing Y, the level of C*a could remain constant or sink (when either C*r rises or S falls by Stk, i.e. by the part of tithe or fees and donations which do not go to the poor11).

A charity economy is static. All income growth is morally distributed. “Investments”, for their part also static, are booked under necessary income in accordance with rank. The social order of the hierarchy of the estates did not allow redefinition of income growth which would have permitted an unproblematic augmentation of the level of the income in accordance with rank. Justice―iustitiadistributiva―demanded a proportionality of estate in- comes. Such a concept became problematic with the increasing wealth from trade in the late Middle Ages and Early Modern Age12.

The ability to reap profits through cleverness which the wealth from trade made apparent13, was hindered by the charity distribution model: The richer the merchant, the greater his superfluum, i.e. his moral distribution fund. Business-related investments were not a particular problem; they were included among the necessary ex- penses of his estate. If however, his profits were greater than reinvestments sums, the problem arose of reas- sessing the estate so that its “income in accordance with rank” was greater than defined in traditional social on- tology. If (high risk) long-distance trade only raised the superfluum but not private disposable income, it would not be undertaken, or only to a limited extent. Such trade investments, which increase profits and superfluum, require the incentives of a legitimate increase in disposable income, so that the transfer of alms can also rise.

Consequently, the income equation of the charity economy changed:

(1a)

I (investments) is not yet defined exactly: whether it is a necessary part of C*r or a deduction from S. The more important the merchant estate became in the social order, the greater was the (ostentatious) consumption defined for it as in accordance with rank. On the other hand, the relatively high potential profits of this estate provided sufficient reasons of conscience to feel guilty vis-à-vis one’s brothers in Christ in order to raise the charitable or alms transfer. However, the interdependence of profit, investment and charitable redistribution re- mained an unsystematic one: One version of the proto-economy, the moral level of liberty of which did not guarantee that the distributive relation between poor and rich was efficiently settled. Charitable superfluum dis- tribution did not take the needs of the poor as yardstick, but instead the guilt requirements of the rich14.

The charity economy developed a one-sided incentive system: The poor received minimal incomes and tangi- ble transfers which they took but could not freely dispose of. The rich gave, but define the objective of the dona- tion. In doing so, they maintained the poor in dependency with the consequence that they may not make the poor any “richer” than they were in their status quo ante of poverty. Hypothetically, every alms which opens up to the poor the possibility of earning their own income lowers that utility which the rich gained from their guilt pay- ments. Logical would be a transfer which allowed the poor to achieve an independent income, a state which would make it impossible, however, for the rich to continue to demonstrate humility and compassion. In the logic of the charity economy, they would be totally fixed on the avaritia, self-interest, i.e. stripped of all morali- ty.

As a consequence, the utility of compassion or charity for the rich was all the greater when their alms pay- ments were lower as this was the only guarantee that the possibility of a demand for compassion―and thus God’s forgiveness for their wealth―would continue to exist.

The poor, as passive recipients of charity, themselves had no influence on the surplus liquidity of the rich ex- cept through an ostentatious display of their poverty and through the strategic thinking of the rich that were God to withdraw his mercy, they would be equally dependent on compassionate support. Behind the “veil of mercy” was hidden divine providence, and a potential loss of rank could be insured against through alms payments.

We can describe the charity economy as a transcendental-pragmatic insurance system in which―in view of the ever-present risk of a withdrawal of God’s mercy―the rich transferred contributions to the poor which in the case of (future) impoverishment would be reimbursed from the superfluum of other rich. In this interpretation, the motive of the rich for compassionately distributing their superfluum would be defined completely independently of a demand on the part of the poor for support―it would only be a two-fold investment by the rich―for the possibility of their own impoverishment and in order to earn points for Judgement Day.

Here, however, one must differentiate exactly between the structure of this economy and the permissible mo- tives for acting: the “insurance effect” was certainly understood, but this had to be seen within the context of a “correct belief”, i.e. in rueful penitence, not as a strategically clever calculation. On Judgment Day, not only the results counted, but also the true motives.

Scholastic theology was clever enough to introduce an escape-clause: A rich man’s quite false, egoistic mo- tives for his actions could be partially compensated for by later regrets and an insight into true motives. Le Goff reconstructed the debate about usury in the following manner: while the bonfire had been developed as an in- termediary purgatory to punish economic sinners, it was tied to the positive effect of afterwards guaranteeing a place in paradise15. Consequently, the transfer income of the poor remained contingent, dependent on the guilt feelings of the rich.

As―in the will of God―the income of the rich also did not remain constant, the distribution fund naturally fluctuated. While a glowing business might well bring ample donations, the decline of the rich left the poor starving while the rich themselves might well retain their livelihood, if not their profits.

Given the ideal assumption that the superfluum was completely transferred to the poor as alms, maintaining the extrema necessitas―the essential transfer income of the poor―was only guaranteed when the income of the rich was significantly higher that their necessarium, their consumption in accordance with rank. Social transfer became even less efficient when the superfluum was not completely transferred, i.e. fewer poor could remain alive or the same number would be even hungrier.

One solution was provided by the institution of endowments (from the estate after death) which had the ad- vantage of not having to pay for alms transfer from a running business, i.e. the constant decision between eco- nomic and charitable calculations was avoided without withdrawing completely from the Christian duty to be compassionate.

Endowments also provided a certain transfer supply continuity, i.e. assets whose transfer volume could be calculated in the long-term (given a relatively constant interest rate). Nonetheless, establishing endowments and providing them with assets remained contingent, i.e. only indirectly oriented towards need. The church adminis- tration coordinated various donations and endowments―and was later assisted by urban organizations―allow- ing a certain organizational efficiency, but not an economic system which remedied the cause of poverty, the lack of work.

Fundamentally, the charitable alms economy remained restricted, however, to “small groups”, to a managea- ble nearby area in the city or domain within which the transfer of surplus liquidity and the needs of the poor could be surveyed. As long as the charity economy could conduct compassionate payments as “brotherly love”, a certain local equilibrium could be achieved.

Only with the state or territorial economy of the 17th century, with the impoverishment of entire regions and with a concentration of poverty in ever larger cities, did the question of poverty begin to reach a dimension which―as the quotation from Marperger well shows―made necessary a “policy”, i.e. care and coordination of welfare. However, more important was the question of how this new dimension of collective poverty could be countered. Voluntary donations arising from penitence were no longer sufficient to efficiently fulfill Christian duty. Thoughts went beyond the question of care for the poor to that of eliminating poverty, i.e. job creation.

3. The Early Modern Alternative

Economics Instead of Morality

A decisive step towards the transformation of the charity economy into the later “classical” economy was pro- vided by John Locke’s work/property rule16. The status of both―rich as well as poor―was tied to their produc- tivity. Consequently, Locke expressly opposed charity which did not take into consideration the just nature of work (justice aspect)17:

“Then for a property owning man, it would always be a sin if he allowed his brother to die because of a lack of support from his own plenty. As justice gives everyone a claim to the proceeds of his honest industry (...) so does charity give to everyone who does not otherwise have the means of a livelihood a claim to that part of the plenty of others which is necessary to preserve him from extreme poverty”18.

Both―justice and charity―are God-pleasing actions which ensue from the plenty, from wealth; charity, however, is restricted to cases of extreme need. The norm is a wage from industrious work.

The superfluum continues to exist, but its character is transformed―it is no longer self-evidently distributed among the poor, but only according to strict criteria.

It is no longer man as simply Christian, but he who―as active Christian―works who has a claim to the su- perfluum. Human dignity in no longer a yardstick of itself, but tied to the competence of work; which is given a two-fold meaning: on the one hand as co-work in the creative process of completing the earthly kingdom of that being characterized by reason, and on the other as active self-support through work19. This sets a new standard: he who works creates property. The poor appear as co-operators who help to create the superfluum of the rich, i.e. the property owners, who then pass it on to the poor as remuneration for their work.

The legal basis was transformed. In Locke’s conception (in the 1st and 2nd Treatise of Government), Chris- tians appear as God’s usufructs, who have taken possession of the Earth as leasehold to the extent of their own productivity20. The economy gained a production theory basis. Income (Y) is no longer a gift of God, but the result of one’s own labor.

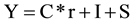

While the income equation is still valid

(1) ,

,

S is assigned a new meaning. It is no longer the Thomasitic superfluum, but instead that part of the profit “in- vested” in wages, i.e. in the labor to maintain one’s own property. As S = Y ? C, a higher level of consumption among the rich reduces employment, i.e. it contradicts the new definition of Christian duty to maintain oneself and others. Locke expressly refers to the maxim from Gen 1. 28: “Be fruitful and multiply, and fill the Earth and subdue it”21.

Still valid is:

(2a) ,

,

but with a completely new definition. Superfluum S is for Locke not a deduction from the consumption of the rich, but almost exclusively investment in waged labor (A). A no longer indicates alms, but paid productivity. The origin of income can be traced back to autonomous factors: those of work. Workers’ income is no longer― as in the poor of the charity economy―drawn from transfers, but from paid productivity, wage income. S is― also in Locke―still a superfluum (Locke speaks of “overplus”22) but it is an investment fund and not a distribu- tive one.

Thus the moral decision of the rich―to find the correct balance between a consumption in accordance with their rank and charitable alms transfer―is transformed into an economic one in which the level of “investment” in employment is measured against the expected profit from the work.

However, Locke does not employ the term “investment”, nor does he have a term capital. Also absent is a theory of labor markets. This relates to Locke’s “mercantile” theory of foreign trade surplus23, which explains the growth of wealth of a nation on the basis of trading profits. To the extent that merchants and traders improve their potential profit by extending world and sea trade, they also improve potential employment, the demand for domestic labor rises and a positive trade balance leads to full employment.

Locke’s conception is nearly identical with that of Marperger quoted at the beginning of this paper; the prob- lem of poverty is solved by a growth in employment due to foreign trade. In this trade-growth economy, there is no oversupply of waged labor or non-owners. Profits and increase in wealth are completely legitimate when they do not foster the “amorsceleratushabendi”24, the avaritia of the Thomasitic charity economy, but are rather used to maintain the utility of the property. Unemployment, i.e. Locke’s poverty, thus becomes no longer a moral problem of restricting the consumption of the rich, but an economic one of a lack of investment. For Locke, this state is identical with that of a negative trade balance.

The use of monetary property from profits is also subject to the property/work rule. Money should not be stored like a treasure (hoarding, idle money), but actively put into circulation, as cash or investment. In the for- mer it is used personally, in the latter, others are given the opportunity of using it. Consequently, interest rates must be unrestricted so that the supply of money can exploit different opportunities for profit, of which neither an interest rate policy nor money lenders have an overview25.

In Locke, the workers are placed in the status of propertyless, but not in poverty. Although propertyless, a worker is not without an income. The propertied depend on the workers as, according to the Locke’s rule legiti- mizing property, only those are held to be propertied who maintain their property through work. As one person’s work can only maintain a certain, limited extent of (landed) property, it is necessary for the property owner to hire others when they own more property than they can work themselves.

A division of ranks is replaced by one between property and work. Property owners take the place of the rich, but workers do not replace the poor. Only those are poor who do not work. If there are reasons for their inability to work, they must be provided with fraternal assistance―according to the rules of the charity economy, which still applied in this case; if there is, however, no legitimate reason, either the poor person has to be forced to work or does not deserve charity. His refusal to assume the Christian state of work is a sin against God’s com- mandment, in Gen. 1.28, to be self-supporting.

The (old) poor of the charity economy appear as unjustified claimants on general wealth in Locke’s concep- tion, as they do not work although they could. They are seen―measured against the new work-ethic―as lazy, with the same status as American Indians, who do not oblige themselves to cultivate their land efficiently and extensively, which is why it was necessary for English Christians to colonize or exploit them through intensive trade. The lazy poor―in comparison with the “industrious men”―come dangerously close to being heathen, to being those who disdain God’s creation plans.

Locke’s economics describes an expanding commercial economy. There are enough possibilities for com- merce around the world; internal restrictions need, however, to be eliminated, especially interest rate policies. A policy of maintaining low interest rates protected borrowers from being overstretched, but this form of ban on profiteering was counterproductive in an expanding commercial economy, as money remained liquid, waiting to make a quick profit instead of being available for investment as demand rose from merchants and sea traders26.

The ban on usury―of extreme importance in the Scholastic―related less to investment credits and much more to private loans. Repayment possibilities were limited as long as they were not backed up by the pros- pects of good profits. The level of interest for loans was to be in proportion to potential income to avoid life- long debt.

However, credits for profitable commercial activities were hindered by the ban on usury. Scholastic theory returned to this problem continually over the centuries and had increasingly defined exceptions27. Locke took up this problem again, finding a radical solution in which interest rates were left to money market developments. This created conditions for investments which went well beyond those which had previously existed. It was only under these conditions, too, that an increase in employment, up to full employment, was possible. Locke defined the conditions for a free market economy, which was just learning to develop its dynamic―one at first restricted to international trade.

In German and Austrian Cameralistic thought―Marperger was a first hint―the pauper police became more repressive in the 17th and early 18th century in demanding compulsory detention in penitentiaries.

“The optimism directed at fostering general well-being in state and individual economies, in trade, industry and agriculture, did not allow poverty and penury to become a central theme. It was not the ending of poverty but an increase in wealth which stood in the middle point of their material economy and police teachings. It thus contradicted the peculiarity of Camaralistic thinkers to limit their ideas on “social policy” to the question of po- verty, where indeed the contemporary demand for workhouses generally dominated. “Social policy” was rather more synonymous with “welfare police”, aiming more at the conditions for preventing poverty and increasing wealth than the ending of existing poverty and the overcoming of its consequences.”28

Vom Bruch generally restricts himself, in this context, to Zincke, Darjes and von Justi and for the 17th century to Becher and Schröder. However, economic thinking on the question of poverty had already developed: Zincke―and later Pfeiffer―were already outlining a relationship between poverty and unemployment. Zincke― as part of his constitutional concept―went as far as to “acknowledge the poor’s direct legal claim to welfare”― which Pfeiffer differentiated into the forms of self-willed and involuntary poverty. The latter provided a basis for claims against the state; the former should continue to be dealt with using proven coercive measures to force people to accept employment29. Pfeiffer had already worked out conceptually important elements of a general social security system30.

Vom Bruch emphasises, in this context, the Camaralistic disposition for a solution to the “social question”, still undervalued in the history of theory, like that developed and described in the late 19th century by the “his- torical” school of German political economists; von Schmoller et al.31

And in fact there exists a “a surprisingly strong German historical continuity”32, which, however, with its po- litical economic tendency, contrasts to the solution to the problem of rich and poor as provided by the English “classical” economy and especially by Adam Smith. Both solutions, however, shared an intention of ending the charitable-moral tradition of “religiously motivated provision of means”. On the basis of his constitutional theory, “Zincke advocated a poverty tax for financing state welfare, while religiously motivated provision of means were at best subsidiary.”33

4. The “Classical” English Economy of Adam Smith

The equation for Locke (1a): Y = Cr + S (more exactly, Cr is not the consumption of the rich, but that of prop- erty owners: Ce) is nearly identical with the Y = C + I (C is the consumption of capital holders, I their invest- ment)―equations of the “classical” economy. There is, certainly, a significant difference; but the dispositions were set in Locke.

In Smith, S means saving. The profit of the rich is divided, as in the charity tradition, into a necessary part (C) and a “surplus” part (S). That part of the profit not spent directly on consumption is saved. The following condi- tion is decisive:

(2b) .

.

(2b) is nearly identical with Locke’s behavioral condition: (2a) S − A. What is new is Smith’s definition of a “labor market” which does not translate S directly into work (A), but gives instead supplementary conditions. The demand for waged labor is dependent on invested capital in relation to wage levels: N = K/w (with N being the effective level of demand for workers, K the wage fund, i.e. the total investment sum available for employ- ment, and w the wage rate).

Wages define workers’ living standards. High wages lead them to have more children which in the long-term increases the supply of labor, so that―with constant labor demand―wages fall. This reduces their ability to support larger numbers of children, the supply of labor falls and in the long-term―in a growth economy―the demand for workers rises again which, because of their restricted numbers, causes the wages to rise and visa versa34.

Smith’s economy is one of capital accumulation. Only when the profits from previous capital investments are re-invested does the demand for workers rise. Smith’s S―I condition is a normative one, which Max Weber would later name, as “Calvinist Asceticism”, as a condition for the rise of capitalism. It is―beyond the Calvinist prototype―a behavioral rule which seeks to indicate that the tendency towards “luxury” among capital holders is counterproductive.

The capital holder is free to consume his profits ostentatiously or to reinvest. However, only when they invest in order to make profits are the able to retain their capital in the long-term. Ostentatious consumption in the present restricts the possibility of consumption in the future. The “luxury” question is no longer a moral one, but rather an economic one of efficient allocation35. Moreover, profit-seeking is no longer vain pleonexy (avaritia), as taught in the tradition of moral philosophy, but rather a “natural interest”, i.e. a natural behavior of self-pre- servation among capital holders, which leads to the preservation of others―capital holders as well as waged la- borers―in the allocation nexus of a process production based on a division of labor.

Hegel, who was familiar with the economic debate, summarized the results of the luxury debate of the 18th century in 1819/20:

“A man of wealth, in times past, supported others directly; he fed the poor and gave them drink, clothed the naked. The other use of wealth is when it is used for luxury. This use has the greater good in that others can only satisfy their needs under the condition that they work. The rich man, who spends much on himself and his plea- sure, can be censured from a moral standpoint and can be told he use his surplus for the benefit of the poor; this he also does, but in an indirect, reasonable manner”36.

Hegel’s words are significant in a number of ways. They show, pointedly―the inversion of the charity eco- nomy in the modern version of an employment economy. However, his words do not go much beyond those of Marperger quoted at the beginning of this paper. Hegel believes that using the surplus for the benefit of the poor is in principle correct, but that doing so through charity is inefficient. It is not the moral guilt feelings of the rich, of having to give to the poor his superfluum because of his being rich, but―on the contrary―his own interest in enjoying luxury which creates employment opportunities. Hegel calls the economic solution of creating demand for labor through demand (for luxury goods) the “more reasonable” form of compassion, which is quite distinct from a, therefore, “less reasonable” charity. That sounds modern, but is rather more the Lockian standard of the 17th century, represented in the 18th century by Smith’s competitor James Steuart, than a reception of Smith’s political economy, of which Hegel was also aware37.

Modern―and moving beyond Locke―is Hegel’s linking of the self-interest of the rich and the distributive consequences of providing the poor with work instead of alms. It is modern in its relation to Smith’s “invisible hand” theory: that following private interests, without giving special moral consideration to others, can nonethe- less increase the wealth of the nation. However, Smith’s universal allocation metaphor relates to a capital eco- nomy38, not to the effect on demand of luxury consumption among the rich.

Smith’s conception of a capital accumulation economy does not depend on a production induced by demand. Instead it is―in Hegel’s terminology―much more “mediated”: rather than indulging in their pleasures, the “rich” should themselves invest. Here, the S ? I condition is decisive, one which does not appear in Hegel―who appears much closer to the Steuartian school in this particular respect39. In the Hegelian interpretation it is suffi- cient to set an equation for the use of income Y = Cr, i.e. to disregard the formula Y = Cr + S. In Hegel, S is neither (Thomastic) superfluum nor (Smithian) saving. Rather, S is included in the consumption of the rich, which creates―broad―employment solely through its demand.

The advance made in this interpretation lies solely in that the total, that is “luxury”, demand of the rich in- cludes not only traditional agrarian products, but also industrial and manufacturing ones, including foreign pro- duction supplied by trade. This certainly does away with the charity economy, but does not yet take in the capi- tal economy.

Here, Smith takes a decisive step forward:

(1c)

(2c)

(4)  (K = fixed capital; W = wage fund = variable capital. Where fixed capital is irrelevant K = W)

(K = fixed capital; W = wage fund = variable capital. Where fixed capital is irrelevant K = W)

(5)  (k = technical (more organizational, based on division of labor) productivity coefficient; N the number of workers)

(k = technical (more organizational, based on division of labor) productivity coefficient; N the number of workers)

The income equation

is nearly identical with the charity equation Y = C*r* + S. S is structurally identical; charitable superfluum serves the transfer of alms to the poor, Smith’s saving serves an investment in employment from which the for- mer poor draw their wages. The most momentous difference is that savings (S), given the S − I condition, presents an economic determinant which contains a free moral decision only to the extent that a tendency towards consumption (luxury)―in which an increase of C occurs at the cost of I―can be held responsible for an imbalance on the labor market (in Smith’s model, all luxury consumption is a lack of investment) which ex- presses itself in a falling demand for workers. With an increasing tendency towards luxury among the rich, em- ployment ceases to rise as quickly or indeed falls in absolute terms, resulting in more poor; that is, unem- ployed40.

In his “Philosophy of Law” of 1821, Hegel described this tendency as an increasing gap between rich and poor which, taken to the extreme, creates a dual rabble: that of the rich, who cast off their moral responsibility to invest; as well as the rabble of the unemployed, who demand their right to work with violence―a reference to the riots in London41.

However, Hegel’s description of the dilemma of bourgeois society is not identical with that of Smith, who saw in the competitive principle of the market a corrective against a tendency towards luxury among the rich, that is capitalists. Competition―if allowed politically―creates an average profit which does not allow capital holders to yield to their tendency towards luxury as they are not able to make such allegedly exorbitant profits in the long-term. In order to have their consumption and to retain their capital, they need to reinvest constantly. Market allocation automatically corrects their alleged excesses42.

The ending of poverty thus finally becomes a problem of investment, i.e. more exactly: one of the conditions of accumulation of capital. However, Smith’s economy contains two normative conditions:

1) The S − I condition, which demands that capital holder transforms his savings fund into investments;

2) The Aa − Na condition (Aa = labor supply; Na = demand for labor), which establishes that workers them- selves govern the demand for labor by restricting the number of children they have. When the (effective, i.e. ig- noring infant death rates) growth rate of the number of children remains below that of the growth of wealth, there can be no oversupply of labor and consequently, wages rise in proportion to the growth of the national product43.

While capitalists were surrounded on the one side by the economic risk of not realizing their expected profit and on the other by the moral risk of investing too little (i.e. of consuming or wasting too much), the poor were faced with the moral hazard―when they had too many children―of producing an oversupply of workers, one not proportional to the possibilities of capital accumulation and thus causing wages to fall. Workers are therefore forced into a position of higher morality, one which they would not voluntarily have taken: That of lowering― out of self-interest―their fertility rate, especially when wages are rising.

However, the two behavioral conditions in Smith are not moral regulations, but rather ones based on individ- ual self-interest; for the capital holder, making profits and for the waged laborer, improving his standard of liv- ing. In this it is a complete inversion of the charity economy.

The superfluum is no longer viewed as a deduction from disposable income, with the inherent danger of no longer being able to reap an income that continues to provide a superfluum. Instead, through the saving/invest- ment condition, a productive use that which was previously reserved for alms is possible, which serves the same purpose functionally, but for completely different reasons.

Functionally, the poor are fed as in the charity economy, but not in a state of unemployment, but rather in one of employment. Consequently, the poor no longer appear as end consumers, but rather as producers or factors of production who help to create the profit from which they draw their income.

The charity economy proves to be a secondary distribution of incomes which seeks to revise a state of ineffi- cient primary distribution. It has no recourse to a production theory; primary distribution lies in God’s hands. Smith, on the other hand―building on Locke’s groundwork―can assume a production process creating a labor value, whose condition is the employment of all social resources. With a differentiation in the division of labor, possibilities for employment are created for the less competent as well. There is no longer any reason to excuse unemployment as due to a lack of training, as there is also no longer any reason for complaining about a lack of employment possibilities. The capital economy is construed as expansive-dynamic.

“I showed you (...) how the far greater parts of the arts and sciences have been invented and improved to supply three great wants of mankind, or subservient to these three ends, food, cloths and lodging; how that man- kind are far better provided in all the necessaries and conveniences of life in a civilized than in a savage state; that plenty and opulence is far greater”44.

In his “Lectures on Jurisprudence” of 1762/63, Smith had not yet developed his capital accumulation theory but was already able to show that, with the division of labor which fosters productivity, the level of welfare rises for everyone. “The dependent poor man who labours both for himself and for others” had a relatively higher standard of living than the “savage prince” who rules over ten thousand wildmen45. This does not put an end to inner-societal differences in income; the “usefully inequality in the fortunes of mankind which naturally and necessarily arises from the various degrees of capacity, industry, and diligence in the different individuals”46 continues to exist.

In this sense, political economy is a moral science in that it transforms older moral and economic modes of behavior into new moral standards, i.e. into a behavioral rationalism which no longer follows historically estab- lished virtues, but instead new allocation conditions. In a choice between “wealth” and “virtue”, Smith plumps for wealth47. Compared to the virtuous but impoverished life of the savage―of the natural state―the civilized state of “commercial society” offers an affluent life, one, however, at the cost of justice48.

Differences in income continues to exist; they do not disappear in the growth process of capital accumulation which Smith later developed, but the wealth of nations increases and allows everyone to take part proportio- nately49.

This solution to the problem of rich and poor was outlined in Locke, but was developed in detail by Smith: The waged laborer remains poor but only relatively compared to the much higher incomes the capital holders earn with their profits. Poverty, in the Smithian system, is no longer comparable with that in the charity econo- my. Rich and poor now describes a difference in the level of income and no longer a difference between having an income or not.

It was here that that another line of thought began, one concerning the question of the level of wages (and their justness)―a theme which would very much determine the 19th century in the “social question”. According to Smith, however, social justice can no longer be attained with a―charitably colored―secondary distribution, as the extent of such a re-distribution would conflict with the preservation of capital productivity. From this point on, the “question of poverty” can be distinguished from the “social question”, i.e. from the question of a suitable wage in respect of growth of the national economy.

Smith’s economic allocation concept questions every moral demand for redistribution of income as to how it influences growth. The morality of the Christian commandment to love others has lost its innocence. There are economic criteria for judging the effect of charity, but that is not the most important: rather more, the charity economy, which defined the economy of rich and poor into modern times, proved to be sub-efficient. The moral economy did not systematically provide what it promised. It was not capable (because of its theological ontolo- gy) of eradicating poverty. Its redistribution system maintained the status quo. The poor remain, as poor, impo- verished, and not as employed who could overcome their poverty on their own―not only with more work, but by learning “skills”, qualifications and by avoiding having too many children―who reduced their standard of living by lowering the individual consumption quota and by reducing wages because of an oversupply of labor.

With the dynamic of an investment-profit-employment system, Smith replaced the traditional ontological term of poverty with that of social poverty, whose distribution antagonisms remain but in which the rising wealth of nations raised the income level of all.

Thus the problem of rich and poor is spread over two dimensions: horizontally in the historical possibilities of increasing income and vertically in the difference in distribution of income between profit and wage income. While the vertical difference continued to exist and became a problem of social economy, the horizontal one between rich and poor could be eradicated in the growth process.

Smith’s solution to the charity economy is based to a great extent only on this second aspect. However, the ontological difference of rich/poor is transformed into a functional one. The rich, who in the charity economy were only indirectly dependent on the poor as subjects of their guilt before God, become directly dependent on the productivity potential of waged laborers in the modern political economy: The indirect objects of God’s mercy, charitably mediated, become economic subjects, i.e. competent to contract, who collectively organize their rights to productivity wages. However, the epoch of redistribution is a post-“classical” phenomenon, for which Smith provided a new foundation without being able to solve it.

Smith’s political economy was a successful attempt at answering the question of how modern (“commercial”) society―which does not see to it that the workers themselves receive the product of their work―is still able to create a higher standard of living for the poorest of the society than every other society in the past50.

To recapitulate the course of argumentation, his answer consisted of requiring the use of the superfluum ex- clusively for productive purposes: S − A was transformed into S − I via the Lockian interim, with A of the char- ity economy no longer defined as redistribution, but as direct investment in work. Locke’s early modern interim solution still lacked a dynamic of capital-growth, something which was central to Smithian economics in that it promised to raise the income of all members of society.

In his growth solution, Smith’s economy found its moral justification for the process of free market alloca- tion51: As only effective growth of the wealth of nations allows proper solutions to income distribution, some- thing always aimed at by the charity economy, but sub-efficiently implemented. Measured against the level of claims of the older morality, the Smithian economy is the introduction into that moral science which, for the first time, not only promised to satisfy moral preferences, but also began to fulfill them.

It is a theory of moral efficiency, not one which has to define virtue―as had previously been the case―as adaptation to given restrictions of scarcity, but rather granting it the ability to itself ease productively those re- strictions of scarcity―a very great step in the history of mankind, which excludes the unconditional inclusion of older models of virtues in the new “system of natural liberty”.

Smith’s theory of the “Political Economy” differs fundamentally from nineteenth-century equilibrium eco- nomics. Firstly, to him the market mechanism regulates the hubris of individual actors by competition and the- reby maximizes the overall interest. This is the “moral justification for the process of free market allocation”. It is a moral mechanism, which offsets the parties’ average profit rates. We are dealing with a moral machine that transfers Mandeville’s maxim about the “natural” greed into an economic concept, in order to increase national product. Secondly, the principles of the capitalist economy get applied to profit and employment. At the time of Smith every investment was essentially in human capital, so that the growth of the “wealth of nations” always meant growth in the number of employees and, albeit much more weakly, growth their income levels. No one should be dependent on charity. Instead, anyone can get income from work in the “Political Economy”. This differs from today’s functional view on the economy, according to which any value added is efficient and growth generating, independent of the conditions of employment, which were central to Smith. For Smith “Po- litical Economy” means an economy that includes all citizens of the nation in the growth pattern. The nation is seen as a great polis. However, this is another story.

References

- Alvey , J. (1988). Adams Smith’s Moral Justification for Free Enterprise―Economic Growth, S. 5ff. Asian Economics, No. 67, 5-28.

- Andreoni, J. (1988). Privately Provided Public Goods in a Large Economy: The Limits of Altruism. Journal of Public Eco- nomics, 35, 57-73.

- Chapman, E. (1939). The Relation between Ethics and Politics According to Aristotle and S. Thomas. Proceedings of the American Catholic Philosophical Association, 15, 176-203.

- Hegel , G. F. W. (1819/20). Die Vorlesung von 1819/20 in einer Nachschrift, (ed.) D. Henrich, Frankfurt am Main (1983).

- Hegel, G. F. W. (1821). Grundlinien der Philosophie des Rechts, Frankfurt am Main (1976).

- Hollander, S. (1973). The Economics of Adam Smith. Toronto: University of Toronto Press.

- Hont, I. (1983). The “Rich Country―Poor Country” Debate in Scottish Classical Political Economy. In I. Hont, & P. Igna- tieff (Eds.), Wealth and Virtue. The Shaping of Political Economy in the Scottish Enlightenment (p. 271). Cambridge: University of Cambrige Press. http://dx.doi.org/10.1017/CBO9780511625077.012

- Hont, I., & Ignatieff, P. (1983). Needs and Justice in the Wealth of Nations: An Introductory Essay (p. 1). In: see: Hont, 1983.

- Langholm, O. (1984). The Aristotelian Analysis of Usury. Bergen: Universitetsforlaget.

- Langholm, O. (1998). The Legacy of Scholasticism in Economic Thought. Cambridge: Cambridge University Press. http://dx.doi.org/10.1017/CBO9780511528491

- Le Goff, J. (1988). Wucherzins und Höllenqualen. Stuttgart: Ökonomie und Religion im Mittelalter.

- Locke, J. (1963). Some Considerations of the Consequences of Lowering the Interest and Raising the Value of Money. London: Printed for Awnsham and John Churchil.

- Locke, J. (1982). Two Treatises of Government. London, Melbourne, Toronto: J. M. Dent.

- Lowe, A. (1954). The Classical Theory of Economic Growth. Social Research, 21, 127.

- Marperger, P. J. (1733). Wohlmeynende Gedancken über die Versorgung der Armen. Dresden: In Verlegung des Autoris.

- Meikle, S. (1995). Aristotle’s Economic Thought. Oxford: Oxford University Press.

- Napp-Zinn, A. F. (1955). Johann Friedrich von Pfeiffer und die Kameralwissenschaften an der Universität Mainz. Wiesbaden: Steiner.

- Priddat, B. P. (1986). Übereinscholastisches Fundament der “Arbeitswert theorie”. bei John Locke: Industriaet diligentia. Diskussions schriftausdem Institutfür Politische Wissenschaft, Universität Hamburg, Nr. 15.

- Priddat, B. P. (1988). Das Geld und die Vernunft. Über John Lockes Versucheinernatur rechtlichbegründeten Ökonomie, Frankfurt am Main. Bern, New York, Paris: Lang.

- Priddat, B. P. (1990a). Hegel alsÖkonom. Berlin: Duncker & Humblodt.

- Priddat, B. P. (1990b). Ökonomie und Macht. In J. Gephardt, & T. der Sektion (Eds.), Politische Philosophie und Theoriegeschichte (pp. 112-138). Baden-Baden: Nomos.

- Priddat, B. P. (2002). Theoriegeschichte der Ökonomie. München: Fink (UTB).

- Reid, G. C. (1989). Classical Economic Growth. An Analysis in the Tradition of Adam Smith. Oxford: Oxford University Press.

- Roscher, W. (1984). System der Armenpflege und Armenpolitik. Stuttgart: J. G. Cotta’sche Buchhandlung.

- Smith, A. (1762/63). Lectures of Jurisprudence. Indianapolis: Liberty Fund.

- Smith, A. (1974). Der Wohlstand der Nationen. München: C. H. Beck Verlag.

- Steuer, G. (1936). Studienüber die theoretischenGrundlagen der Zinslehrebei Thomas von Aquin. Stuttgart.

- Todd Lowry, S. (1987). The Archaeology of Economic Ideas. The Classical Greek Tradition. Durham: Duke University Press.

- Todd Lowry, S., & Gordon, B. (Eds.) (1998). Ancient and Medieval Economic Ideas and Concepts of Social Justice. Leiden/New York/Köln: Brill Academic Publishers.

- Vom Bruch, R. (1988). Wissenschaftliche, institutionelleoderpolitische Innovation? Kameralwissenschaft―Polizeiwissen- schaft―Wirtschaftswis senschaftim 18. Jahrhundertim Spiegel der Forschungsge schichte, p. 77 ff. In N. Waszek (Ed.), Die Institutionalisierung der Nationalökono mieandeutschen Universitäten (pp. 1937-1986). St. Katharinen: Zur Erinnerungan Klaus Hinrich Hennings.

- Wittreck, F. (2002). Geld als Instrument der Gerechtigkeit. Die Geldrechtslehre des Hl. Thomas von Aquin in ihreminterkulturellen Kontext. Paderborn: Schöningh.

NOTES

2 Marperger, 1733: p. 2 (translation in English by the author).

3Except for example in W. Roscher, 1894 ―one of the famoust German economists of the 19th century: “If everyone were true Christians, there would be no poor and no welfare” (Roscher, 1894: p. 1) . In general see Todd Lowry/Gordon, 1998 .

4 Todd Lowry, 1987; Meikle, 1995; Todd Lowry/Gordon, 1998 .

5See in general: Chapman, 1939, Steuer, 1936 and, for the part of money, Wittreck, 2002 .

7 Steuer, 1936: p. 66 ; “pecatummortale”, 71.

8 Steuer, 1936: p. 69 . See also Chapman, 1939 .

9The charity model of modern economics defines the behaviour of compassionate donors as “altruistic” (Andreoni, 1988: 57 f) .

10Only when the church collection Stk―with relatively constant maintenance costs K―transfers its increase to the poor (Stk = K + A) is the charitable task fulfilled. However, the church had other tasks to fulfil in the Middle Ages, e.g. they had to display their power.

11When Stk = K, instead of Stk = K + A.

12Also problematic became the other old basement of the economic thinking of the Middle Ages: the economic theory of Aristotle; see Langholm, 1984 und 1998; Todd Lowry/Gordon, 1998; Priddat, 2002: Chap. 1 .

13Industria et diligentia: Priddat, 1986; Langholm, 1984: pp. 100-103 .

14As such, the preference of the rich cannot be defined as altruistic. Altruism has as its purpose the disregarding of ones own aims, i.e. of self-interest. Payment motivated by guilt feelings or as penitence has, however, other aims than helping the poor or forgoing one’s own interests. Rather the intentions were very much those of self-interest, which in this case were merely not “of this world”. Objectives which follow “transcendental” needs should be evaluated differently than altruistic ones.

15 Le Goff, 1988: p. 68 ff . According to Le Goff, the exceptions legitimising interest arise within this framework: 1. Damnum emergens, 2. Lucrumcessans, 3. Stipendium laboris, 4. Periculumsortis, 5. Ratio incertitudinis. The first three exceptions are compensation (1 because of late payment, 2 because of preventing a permissible profit, 3 as recompense for work) the latter two are based on risk-taking; 4 because of the danger of losing lent capital and 5 in consideration of insecurity (Le Goff, 1988: 75 ff) .

“Thus a growing number of usurers had the opportunity to be saved from damnation either through their own moderation or by shifting their activities into new areas or into permitted interest-bearing lending. However, numerous usurers continued to be threatened with damna- tion because of their professional practices.” (Le Goff, 1988: p. 77) For them, the bonfire was re-introduced in the 12th century; Theology adapted itself to lending practices. The previously absolute damnation became a relative one.

16In his famous 5th chapter of the 2nd Treatise of Government, Locke defined property rights as something which could only be legitimised by the work necessary for it. In doing so, he separated the right of occupatio from the right of appropriatio. For more details, see Priddat, 1998; Priddat, 1990b and especially: Locke 1982: II, Chap. 5.

18 Locke, 1982: I § 42 .

19 Priddat, 1990b .

20 Priddat, 1990b .

21 Locke, 1982: I § 33 and 41 .

22 Locke, 1982: II § 50 .

24“Concupiscence desire”: Locke, 1982: II § 111.

25 Locke, 1963; Priddat, 1988: Chap. III .

26 Priddat, 1988: 127 ff, 236 f .

27 Le Goff, 1988 .

34Smith, 1978: 1st Book, Chap. 8.

35 Smith, 1974: 278 ff .

36 Hegel, 1819/20: p. 160 (translation of the author).

37See for greater detail on the difference between Smith and Hegel and Steuart’s influence on Hegel: Priddat, 1990a .

38 Smith, 1974: pp. 530, 582 .

40 Smith, 1974: p. 280 .

42 Alvey, 1988: p. 23 .

43 Smith, 1974: 60 f and 64; Lowe, 1954: 133 f; Hollander, 1973: p. 186; Hont, 1983: p. 299; Alvey, 1988: Chap. 3 .

47 Hont/Ignatieff, 1983: 6 f, 10 f .

48 Hont/Ignatieff, 1983: p. 3 .

49On the Smithian theory of growth most recently: Reid, 1989: esp. Chap. 1-4 .

50 Hont/Ignatieff, 1983: p. 4 .

51 Alvey, 1988 .

上一篇:On the Jesuit Edition of Newto 下一篇:Music, Eurocentrism and Identi

最新文章NEWS

- On the Jesuit Edition of Newton’s Principia. Science and Advanced Researches in the Western Civiliza

- The Utrecht District and the Disputed Territory—A Cause of the Anglo-Zulu War Re-Examined

- Pseudo Nationalism of the Commercial Companies on the Commemoration of Indonesian National Holidays

- Maxwell’s Dynamical Philosophy: An Early Solution to the Problem of a Discrepancy between Particles

- Joseph K. Claims Compensation: Franz Kafka’s Legal Writings

- Historic Charcoal Production in the US and Forest Depletion: Development of Production Parameters

- Trk Family Neurotrophin Receptors and p75 Receptor. A Multiple Competing Hypothesis Case in the Nerv

- History of Two Fundamental Principles of Physics: Least Action and Conservation of Energy

推荐期刊Tui Jian

- Chinese Journal of Integrative Medicine

- Journal of Genetics and Genomics

- Journal of Bionic Engineering

- Pedosphere

- Chinese Journal of Structural Chemistry

- Nuclear Science and Techniques

- 《传媒》

- 《中学生报》教研周刊

热点文章HOT

- The Impact on Cayey, Puerto Rico of the Spanish American War: The Evolution of a Place Called Henry

- An Original Mid-Nineteenth Century Scientific Instrument in Italy: Vincenzo Vignola’s Induction Coil

- DANTE’s Medical Knowledge: The Case of INFERNO, Canto XXX

- The Campaign of Asad Bin Alfurat to Conquer Sicily

- Joseph K. Claims Compensation: Franz Kafka’s Legal Writings

- A Macabre Exhibit: Ugandan President Museveni’s Public Display of the Luwero Triangle War’s Human Re

- The Shaping of Inquiry: Histories of the Exact Sciences after the Practical Turn

- First Aerial South Atlantic Night Crossing